The Federal Housing Administration (FHA) and Housing

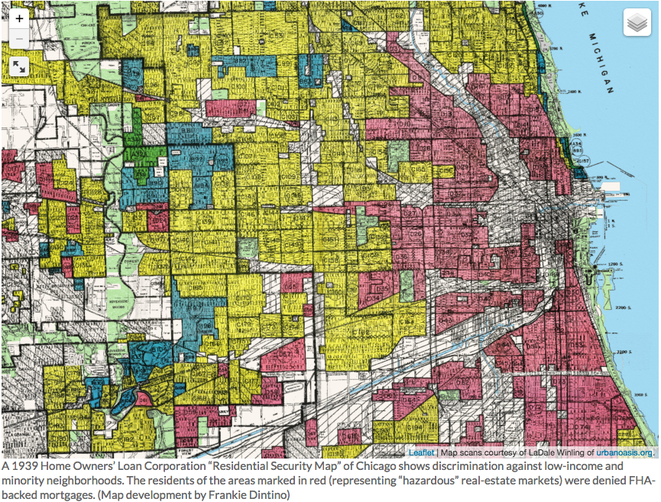

The Federal Housing Administration was created by Congress in 1934 to guarantee private mortgages, which in turn would cause a drop in interest rates and a decline in the size the down payment required to buy a house. As this organization strived to better the real estate economy, it damaged the value of many African American and homes through their use of maps that rated neighborhoods according to their perceived stability. These maps would have manly three different colors on them: Green, Yellow, and Red. Each color represented the stability of the neighborhood as well as its probability for insurance. Green area, also rated as "A", were neighborhoods that were considered safe and excellent prospects for insurance. On the other end of the spectrum we have red, also rated as "D". These neighborhoods were considered unsafe and usually considered ineligible for FHA backing. This system of color coding was also referred to as "redlining" which not only increased the racism within backed loans and the mortgage industry, but excluded African Americans from the most legitimate means of obtaining a mortgage.

Perception of FHA

"'A government offering such a bounty to builders and lenders could have required compliance with a nondiscrimination policy,' Charles Abrams, the urban-studies expert who helped create the New York City Housing Authority, wrote in 1955. 'Instead, the FHA adopted a racial policy that could well have been culled from the Nuremberg laws.'" (Coates)

|

African Americans who wanted and were able to afford home ownership found themselves limited to central-city communities where their homes and communities deteriorated and lost value in comparison to the homes and communities supported by the FHA and seen as safe and reliable neighborhoods, or simply put, "white" neighborhoods.

Another housing restriction that was set upon the African American population was the method of buying a house on "contract". "On contract" is a vulturous agreement that combined all the responsibilities of homeownership with all the disadvantages of renting, while offering the benefits of neither. This way of purchasing a house allowed "contract sellers" to by a property at a low cost and then turn it around for more than double the price he bought it for. The seller also owns the property until the contract is paid in full which allows the seller to take away the down payment, all monthly payments, and the property itself if the buyer misses a single payment. Sellers would use this process to their advantage and sell inflated homes to people that they knew couldn't afford the price and then evict them once they couldn't pay the monthly cost. Given that about 85 percent of all black home buyer who bought a home bought on contract, "contract sellers" became outrageously wealthy. So in reality African Americans were dealing with both the unfair process of buying on contract as well as getting no support from the Federal Housing Administration (FHA), which made having a house extremely difficult and very costly. |